Your financial needs are as unique as your life experiences and goals. You may be planning to buy a house, send your children for higher studies or even retire early. No matter what your milestones, you need a protection solution that is tailored to help you prepare for different life events. Presenting Future Generali Care Plus – a term life insurance plan that is designed keeping your needs and preferences in mind. So that you can secure your family’s lifestyle, today and tomorrow.

Depending on your protection needs, you can choose from any one of the following options: Option 1: Life Cover Option 2: Extra Life Cover (Life Cover with Accidental Death Benefit) Your premium amount will vary according to the option you have chosen. The option has to be chosen at inception and cannot be changed during the term of the policy.

The plan gives you the flexibility to choose the period of protection and the period of premium payment (minimum policy term and premium payment term of 5 years).

The Policyholder can choose lump sum payout, fixed monthly payout or a combination of both payouts to receive the Death Benefit upon death of Life Assured. The policyholder can choose to change any of the payout options during the Policy Term but before the occurrence of insured event.

Choose a protection option that works for you

Choose the amount of insurance cover (Sum Assured) you desire under this policy.

Choose the duration of cover (Policy Term) and Premium Payment Term as per your convenience.

Get your premium calculated and fill the proposal form (application form). Our advisor will help you with a customised quote.

Note:

| Parameter | Criterion | |

|---|---|---|

| Entry Age (As on last Birthday) | 18 years to 65 years | |

| Maturity Age (As on last Birthday) | 23 years to 85 years | |

| 5 Years |

| 10 Years |

| 15 Years |

| 60 years less age at entry subject to minimum of 5 years |

| Sum Assured | Minimum – Rs. 25 Lacs Maximum – As per Board approved Underwriting policy |

| Accidental Death Sum Assured | Minimum –Rs. 5 Lacs Maximum– Base Sum Assured or Rs. 2 Crores, whichever is lower (Subject to Board Approved Underwriting policy) |

| Premium Payment Frequency | Yearly, Half Yearly, Quarterly and Monthly |

| Premium Payment Type | Regular Pay | |

|---|---|---|

| Premium Payment Term | 25 years | |

| Policy Term | 25 years | |

| Age at entry | Option 1: Life Cover(Base Sum Assured = Rs. 1 crore) | Option 2: Extra Life Cover (Life Cover with Accidental Death Benefit)(Base Sum Assured = Rs. 1 crore) |

| 30 | 8,534 | 13,004 |

| 30 | 12,277 | 16,747 |

| 35 | 18,541 | 23,011 |

| 40 | 28,796 | 33,344 |

| 45 | 45,373 | 50,633 |

| 50 | 72,016 | 78,331 |

Death Benefit

Maturity Benefit

Note for:-

Let us understand this benefit with the help of examples:

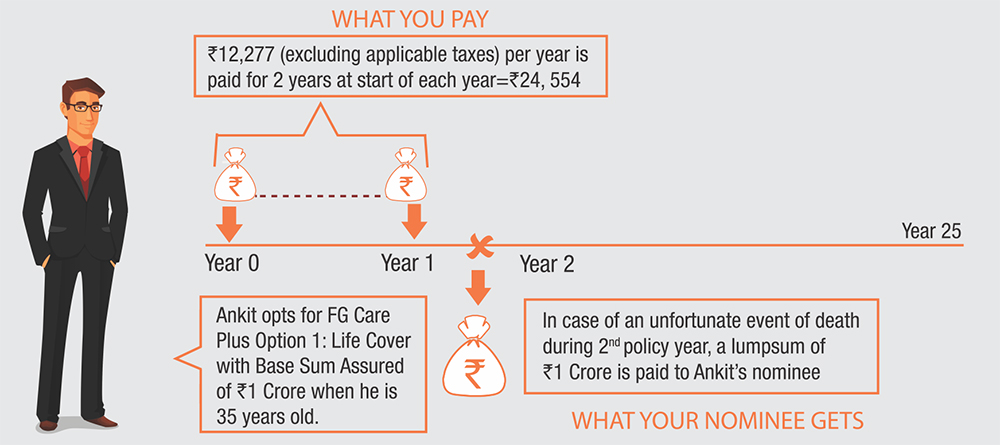

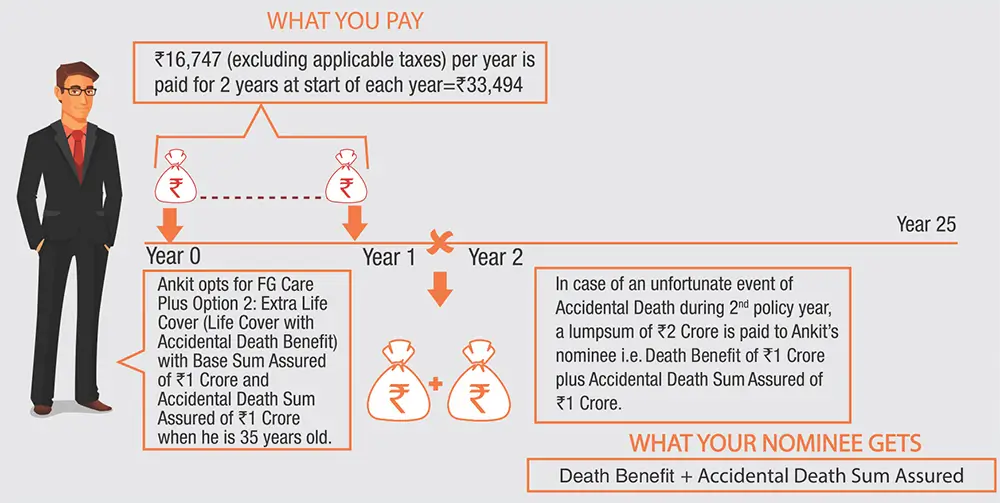

Ankit is a 35 years old healthy non-smoker male. He buys the Future Generali Care Plus for 25 years and chooses to pay annual premium for 25 years.

Example 1: He chooses Option 1: Life Cover with Base Sum Assured of Rs. 1 Crore

Example 2: He chooses Option 2: Extra Life Cover (Life Cover with Accidental Death Benefit) with Base Sum Assured of Rs. 1 crore and Accidental Death Sum Assured of Rs. 1 Crore.

Note: In the above example, in case of death other than due to accident under Option 2: Extra Life Cover (Life Cover with Accidental Death Benefit) only Death Benefit of Rs 1 Crore shall be payable and no Accidental Death Sum Assured shall be payable.

There are no maturity benefits under this plan.

In each of the policy options, the policyholder can choose to receive the Death Benefit as per the following payout options. The default payout option is Lump-sum payout. The policyholder can change to any of following the payout options during the policy term but before the occurrence of insured event.

You get a grace period of 30 days for Yearly, Half-yearly and Quarterly Premium Payment Frequency and 15 days for Monthly Premium Payment Frequency from the due date, to pay your missed premium. During these days, you will continue to be covered and be entitled to receive all the benefits subject to the deduction of due premiums. If any Instalment Premium remains unpaid at the end of the Grace Period, the policy shall Lapse.

| Half-yearly Premium | 52.0% of annual premium |

|---|---|

| Quarterly Premium | 26.5% of annual premium |

| Monthly Premium | 8.83% of annual premium |

There are no riders available in this policy.

There are no loans available under this policy.

Premium rates are guaranteed for the entire policy term.

In case of death of Life Assured due to suicide within 12 months from the date of commencement of risk under the Policy or from the date of Revival of the Policy, as applicable, the Nominee or beneficiary of the Policyholder shall be entitled to 80% of the total premiums paid till the date of death or the policy cancellation value available as on the date of death whichever is higher, provided the Policy is in force.

You will not be entitled to any accidental death benefit directly or indirectly due to or caused, occasioned, accelerated or aggravated by any of the following:

This exclusion will not be applicable to conditions, ailments or injuries or related condition(s) which are underwritten and accepted by Us at inception or at reinstatement

For Regular Pay policy where premium payment term is equal to policy term:

For Limited Pay policy where premium payment term is lesser than policy term:

There is no Paid Up benefit available under this product.

There is no surrender value available under this product. However, Policy Cancellation Value shall be applicable under this product as defined below.

For Regular Premium where premium payment term is equal to policy term: No policy cancellation value is available under regular premium policies.

For Limited Premium Payment Term where premium paying term is lesser than policy term: We encourage you to continue your policy as planned, however, you have the option to cancel the same any time after the payment of first three (3) consecutive full policy years’ premiums i.e. after which the policy acquires a cancellation value.

Policy Cancellation Value Factor will be as below:

| Policy Year of Cancellation | Factor |

|---|---|

| 1-2 | 0% |

| 3-5 | 30% |

| 6-9 | 40% |

| 10-14 | 50% |

| 15 and above | 60% |

Policy Cancellation value will not be payable if the policy is cancelled in the last policy year.

The policy terminates on policy cancellation and no further benefits are payable under the policy.

Nomination shall be in accordance with Section 39 of Insurance Act, 1938 as amended from time to time.

Assignment shall be in accordance with Section 38 of Insurance Act, 1938 as amended from time to time.

Section 41 of the Insurance Act 1938 as amended from time to time states

Section 45 of the Insurance Act 1938 as amended from time to time states

For further information, Section 45 of the Insurance laws (Amendment) Act, 2015 may be referred.

Future Generali Care Plus (UIN: 133N030V05)

For detailed information on this product including risk factors, terms and conditions etc., please refer to the product brochure and consult your advisor before concluding a sale. Tax benefits are as per the Income Tax Act 1961 and are subject to any amendment made thereto from time to time. You are advised to consult your tax consultant. Future Group’s and Generali Group’s liability is restricted to the extent of their shareholding in Future Generali India Life Insurance Company Limited